estate tax law proposals 2021

Potential Estate Tax Law Changes To Watch in 2021. Tax Legislation in the 117th Congress The likelihood of candidate Bidens tax proposals becoming law will be dependent upon control of Congress in January 2021.

Corporate Partnership Estate And Gift Taxation 2021 1st Edition Pratt Solutions Manual Pratt Corporate Solutions

Ad Wells Fargo Will Work With You And Your Team of Advisors To Develop A Comprehensive Plan.

. The Biden Administration has proposed sweeping estate tax impacts to the estate and gift structure. While there is still a lot of uncertainty at this point we do know that big changes are on the horizon. Ad From Fisher Investments 40 years managing money and helping thousands of families.

2021 Estate Tax Proposals. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022. In September we posted on the sweeping tax changes proposed by The Ways and Means Committee of the House of Representatives.

November 03 2021. On September 13 2021 the House Ways and Means committee released its proposals to raise revenue including increases to individual trust and corporate income taxes changes to retirement plan contr. The Biden campaign is proposing to reduce the estate tax exemption to 3500000 per person.

The current estate gift and generation-skipping transfer GST tax exemption is 117 million per person with a top tax rate of 40 which is set to sunset at the end of 2025 to pre. President Bidens Build Back Better plan currently wending its way through Congress. The proposed impact will effectively increase estate and gift tax liability significantly.

For the last 20 years the battle over estate taxes has centered around the elimination of the estate tax and the accompanying step up in basis and the amount of the federal. 2021 Federal Estate and Transfer Tax Law Proposals. Proposed Federal Estate and Gift Tax Legislation.

Nevertheless the time for estate planning is now. If a decedent were to die in 2021 with an estate of 11700000 there would be zero tax due on the estate and a full step up in tax basis on all assets to the value on the decedents date of death. The Wealth Advisor Contributor.

Click to play an audio version of this article. The subject of taxes due at death has gained attention because President Biden proposed in April 2021 eliminating the so-called step-up in basis for gains above 1 million or 2 million per couple and making sure the gains are taxed if the property is not donated to charity. Sheldon Whitehouse aims to curtail planning strategies used mainly by 05 of wealthy Americans to avoid tax.

Current Law in 2021. Under the proposed legislation the federal estate tax exemption which is the amount of ones estate that can pass free from tax at death would be sharply reduced. This year has brought many proposals to Congress that would dramatically change the tax implications for many farm businesses.

Bernie Sanders and Rep. Income and estate tax planning before a change in the law occurs. September 20 2021.

That could have potentially hit millions of middle-class Americans including elderly who own. This year has brought many proposals to Congress that would dramatically change the tax implications for many farm businesses. The Democrats of the House of Representatives have released a much-anticipated tax plan that would significantly impact the federal estate and gift tax system.

New federal tax legislation is on the horizon with significant changes for estate and gift taxes. Director Nebraska Farm Business Inc. Under current law the existing 10 million exemption would revert back to the 5 million exemption amount on January 1 2026.

However on October 28 and then again on November 3 the House Rules. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

Note the tension in current year planning if this proposal is adopted. With Access To Our Free Estate Planning Checklist You Can Start Developing A Plan Today. November 16 2021 by Jennifer Yasinsac Esquire.

Key proposals in the estate planning realm that have been. Importantly the House could still amend this legislation and the Senate is actively working on its own bill. Proposed effective date is retroactive to January 2021.

By Cona Elder Law. 2021 Federal Estate and Transfer Tax Law Proposals. Payment of the capital gains tax would secure the step up in basis at death.

Bidens Tax Proposals And Estate Planning. If the current split in control the House currently is controlled by the Democrats and the Senate. Consumer IssuesConsumer Protection News and Events.

The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to income tax and estate and gift tax. 2021 Federal Estate and Transfer Tax Law Proposals. PROPOSED ESTATE AND GIFT TAX LAW CHANGES OCTOBER 2021.

Following weeks of negotiations between President Joe Biden and congressional Democrats the White House released a retooled framework for the Build Back Better Act on October 28. The For the 995 Act sponsored by Sen. The estate tax changes that were anticipated in the final months of 2021 are apparently not materializing leaving some people scratching their heads as to what they should do next.

The federal estate tax would apply at death to. A reduction in the annual gift tax exemption from 15000 per person per donee to an annual per donor maximum of 20000 per year. KL Gates law firm prepared the following advice published to JD Supra.

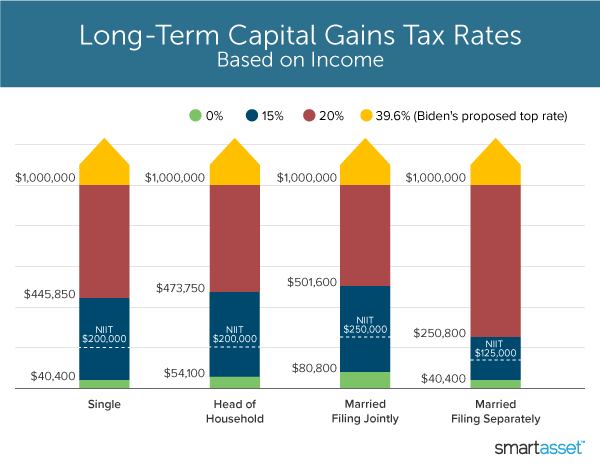

What S In Biden S Capital Gains Tax Plan Smartasset

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

It May Be Time To Start Worrying About The Estate Tax The New York Times

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

Biden S Budget Proposes Tax Hike On Married Filers Over 450 000

Build Back Better 2 0 Still Raises Taxes For High Income Households And Reduces Them For Others

How Is Tax Liability Calculated Common Tax Questions Answered

It May Be Time To Start Worrying About The Estate Tax The New York Times

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Secured Property Taxes Treasurer Tax Collector

What Happened To The Expected Year End Estate Tax Changes

State Death Tax Hikes Loom Where Not To Die In 2021

Property Taxes For Minnesota Communities To Increase By 4 5 In 2022 Axios Twin Cities

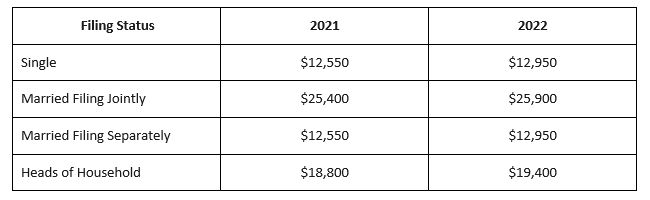

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax United States

What Does Being Audited By The Irs Mean Https Www Irstaxapp Com What Does Being Audited By The Irs Mean Tax Write Offs Tax Organization Tax Services

How Do State Estate And Inheritance Taxes Work Tax Policy Center

House Democrats Tax On Corporate Income Third Highest In Oecd

How Is Tax Liability Calculated Common Tax Questions Answered

How Is Tax Liability Calculated Common Tax Questions Answered